Project information

- Category: Artificial Intelligence

- Project date: November, 2023

- Project URL: github.com/BonelessWater/Neural_Network

Inspiration

In order to apply to an investment fund club at UF, I was asked to come up with a novel trading strategy. My solution was to question which technical indicators were more responsible for detecting correct buy-sell signals

Explanation

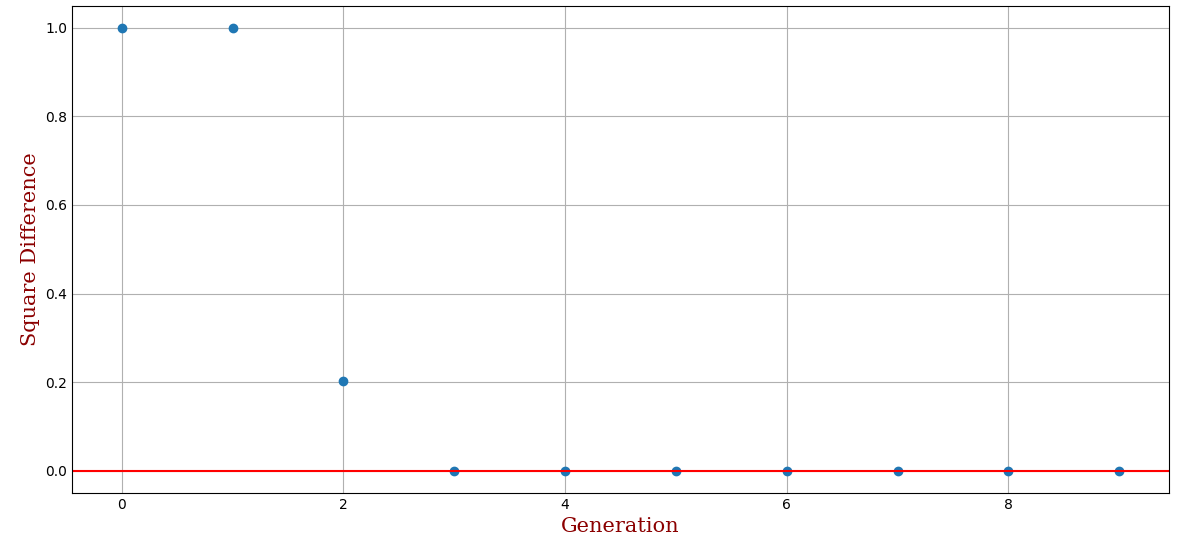

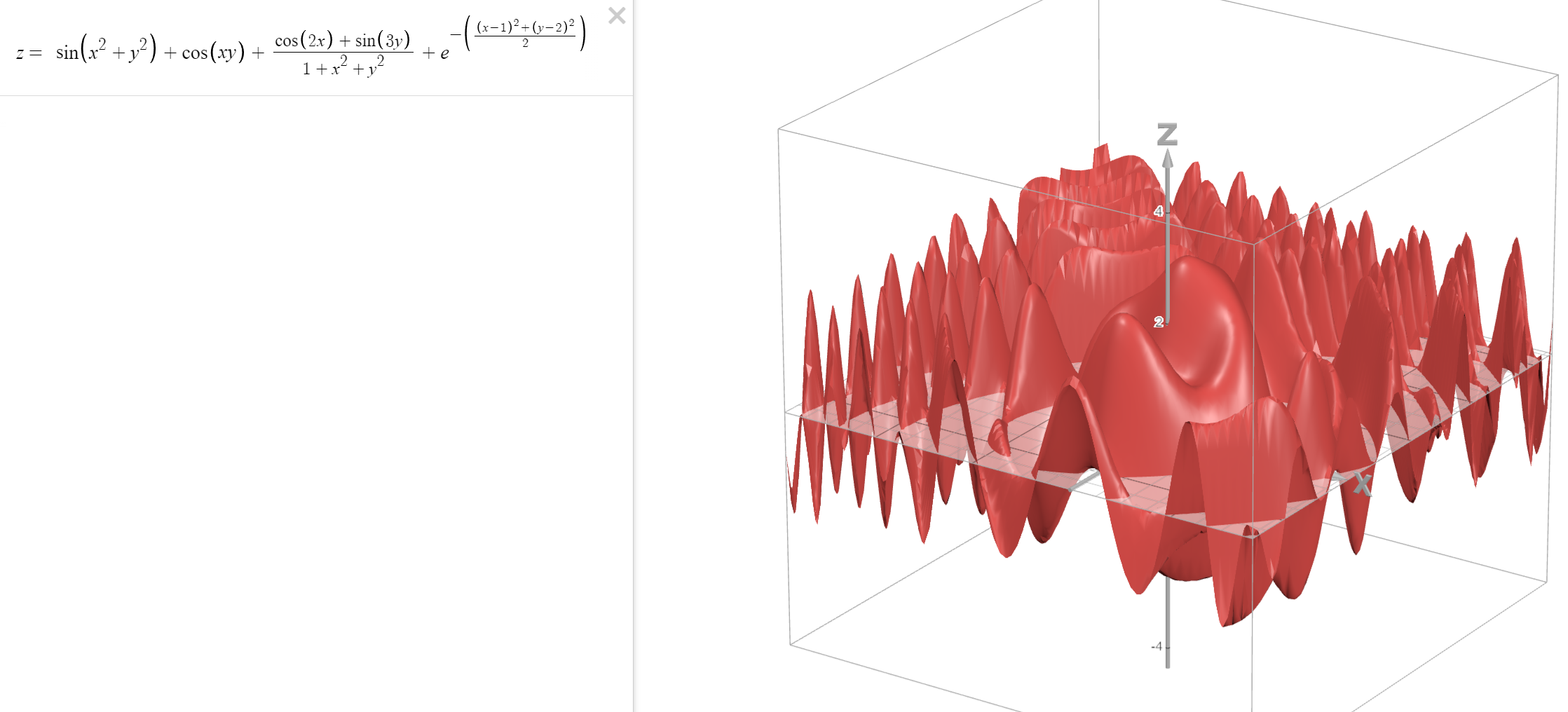

The model is a back-propagated dynamic neural network written in python which alters its node structure at random to prevent overfitting. The network went through a training phase where it received stock data and relative indicators such as RSI, MACD, SMA, %K, %D and others to predict buy-sell signals with 52% accuracy.

Takeaways

After normalizing the weights between each node and the next layer, I found that the MACD was most responsible for knowing when to buy or sell.